Mastering "Partial Covered Calls" - Part 1

Covered Calls

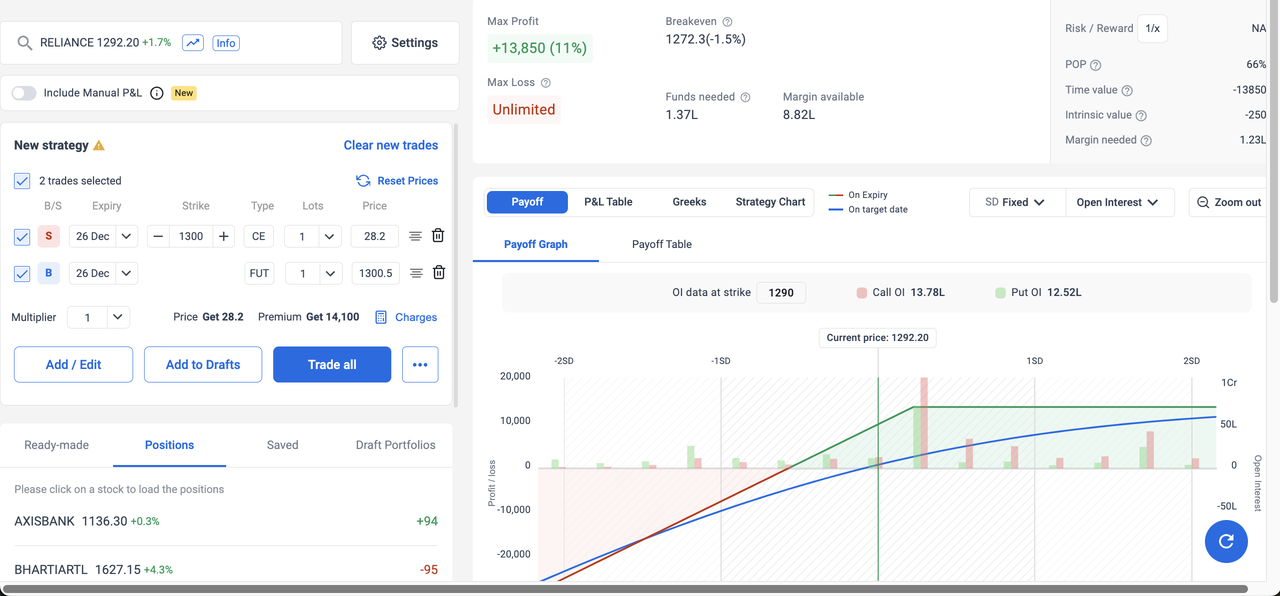

In a covered call strategy, we buy one lot of stocks (or 1 Future) and sell at the money call option. The payoff diagram looks like this:

There are 2 drawbacks of this strategy:

- It requires a lot of capital to buy the shares. We can't fully use the margin from pledging the stocks.

- We need to sell the stocks at expiry if stock price closes above the strike price.

To overcome this limitation, we can use a strategy called "partial covered calls."

Partial Covered Calls

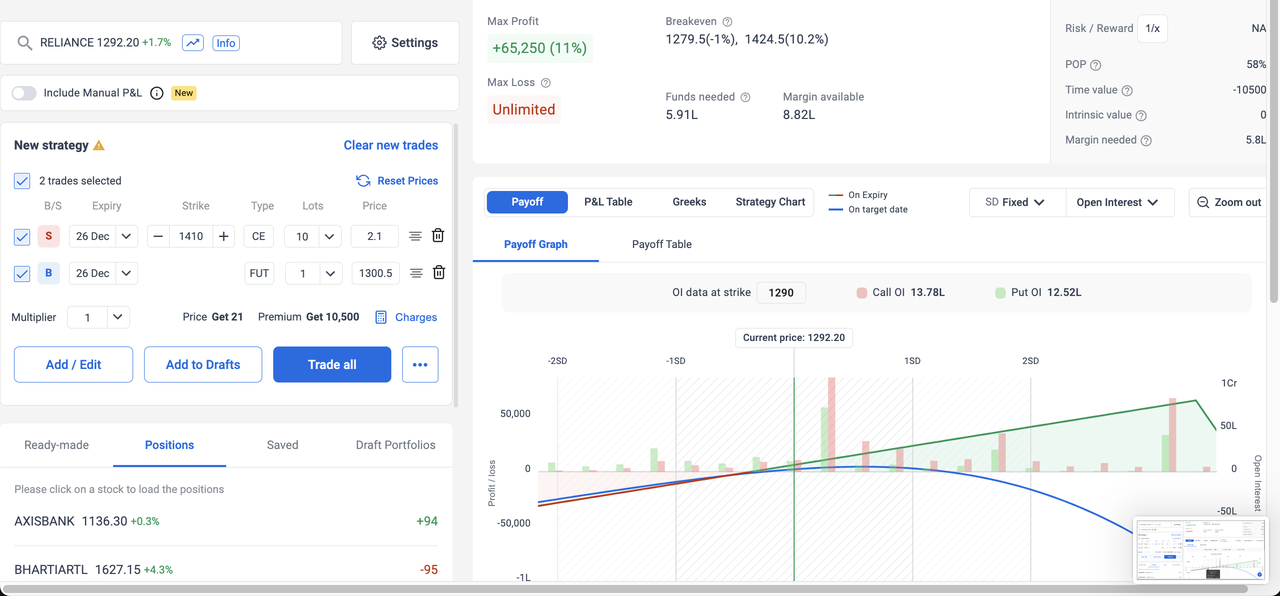

Instead of buying one lot of shares, we can buy "partial" or "fractional" lot of shares and then sell a far away call option instead of at the money call option.

For example, we can buy 0.15 lot of shares and sell a call option which is 10% away from the current price. The payoff diagram looks like this:

Here we can pledge the stocks we have bought and use the margin to sell call option using that margin.

Since we are selling a call option which is far away from the current price, the probability of the call option getting exercised is very low. So we can keep the premium we received from selling the call option.

In addition to that, we get the long term capital appreciation of the stocks we have bought and there won't be short term capital gains tax on them.

Conclusion

If you want to hold the stock for long but still want to generate regular income from it, then partial covered calls is a good strategy to consider.

Need further help with this? Feel free to send a message.